In the competitive landscape of modern business, every single touchpoint with a client is an opportunity to either build or damage your brand. You invest in sleek websites, engaging social media, and top-tier services. But what about the final impression? The document that seals the deal and gets you paid? Your current invoices.

Many businesses overlook the critical role these financial documents play. What if we told you that your seemingly simple requests for payment are actually damaging your reputation, making you look unprofessional, and even contributing to unpaid invoices? It’s not just about getting paid; it’s about reinforcing your brand’s value, professionalism, and trustworthiness. If your billing process looks sloppy, your entire operation might appear that way too.

The Silent Assassin Unprofessional Invoices

Think about the last time you received a messy, hard-to-read bill. Did it inspire confidence? Probably not. Research from various payment processing firms consistently shows that over 60% of small businesses report experiencing late payments, with a significant portion attributed to unclear or unprofessional billing. This isn't just a cash flow problem; it's a branding disaster in the making.

Your business invoices are more than just a request for money; they are an extension of your brand. They reflect your attention to detail, your organizational skills, and your commitment to a smooth client experience. If your client receives a generic, error-filled, or poorly formatted request, it subtly (or not so subtly) communicates: "We’re not as professional as we claim."

The Damage to Your Brand Image: More Than Just Money

The impact of unprofessional invoices online goes far beyond delayed payments:

- Erosion of Trust: A sloppy document can make clients question your competence in other areas. If you can't even get your billing right, what else are you cutting corners on?

- Perceived Value Drop: A cheap-looking invoice can devalue your high-quality services. You've delivered premium work, but your billing says "bargain bin."

- Client Frustration: Confusing or incomplete invoices sent create extra work for the client’s accounting department, leading to annoyance and potentially slower payment processing.

- Word-of-Mouth Damage: Clients talk. A frustrating billing experience is a negative story they might share with potential referrals, harming your reputation.

Why "Good Enough" is Killing Your Business Invoices

Many businesses fall into the trap of thinking their billing is "good enough." They might be using:

- Basic Word or Excel Templates: These are prone to formatting errors, look generic, and lack professional polish.

- Handwritten Notes: An absolute no-go for any professional service.

- Generic Email Body Text: Easily overlooked and lacks any visual authority.

These methods actively sabotage your efforts to maintain a strong brand image. Your invoices should be as meticulously crafted as your product or service.

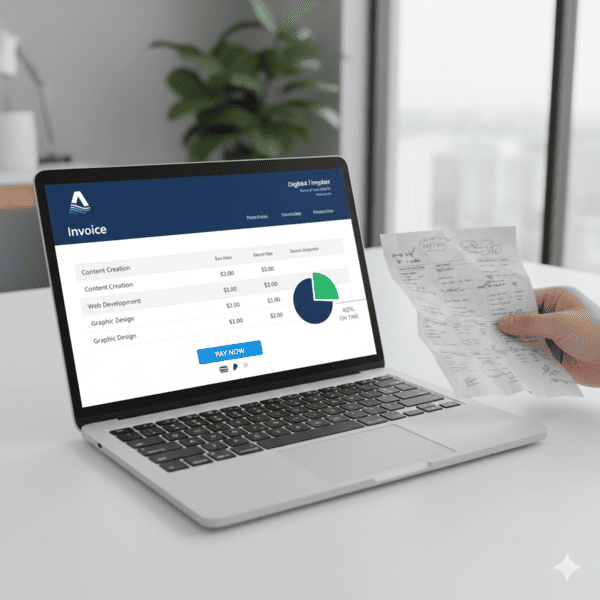

The Solution: Professionalism from First Impression to Final Payment

So, how to create invoices that enhance, rather than harm, your brand? The answer lies in standardization, clarity, and professionalism.

1. Branding Consistency: Your Logo, Your Authority

Every document leaving your business should loudly proclaim your brand. Your invoices sent should prominently feature your logo, brand colors, and contact information. This isn't vanity; it's a strategic move. When a client sees a consistently branded document, it reinforces your identity and builds recognition. It differentiates you from the sea of generic bills.

2. Crystal Clear Details: No Room for Confusion

Ambiguity is the enemy of prompt payment. Your business invoices must be clear, concise, and complete. Include:

- A unique invoice number for easy tracking.

- The exact date of issue and a firm due date.

- An itemized list of services or products with clear descriptions and costs.

- Total amount due, clearly highlighted.

- Your payment terms and accepted payment methods.

When clients have all the information they need at a glance, they have no reason to delay.

3. The Power of PDF: The Professional Standard

Forget editable Word docs or plain text emails. Professional invoices online should always be in PDF format.

- Security: PDFs are much harder to alter, preventing disputes.

- Integrity: They maintain their formatting across all devices, ensuring a consistent look.

- Universal Acceptance: Most accounting departments prefer or require PDFs for their records.

This simple format choice immediately elevates your professionalism and streamlines the client's payment process.

4. Automated Reminders: Gentle Nudges, Not Nagging

One of the biggest contributors to unpaid invoices is simple forgetfulness. However, constantly sending manual follow-ups is taxing and can feel unprofessional. Implementing a system that sends automated, gentle reminders is key. These aren't just polite prompts; they are part of a professional system that ensures payments stay top-of-mind without you having to manually chase every client.

5. Seamless Payment Options: Make it Easy to Pay

The harder it is for clients to pay the invoice, the longer it will take. Integrate clear calls to action directly on your invoice:

- Include a "Pay Now" button that links directly to a secure payment gateway.

- Clearly list bank transfer details if that's your preferred method.

- Offer diverse payment options to accommodate client preferences.

By removing payment friction, you're not just improving your cash flow; you're creating a positive, efficient experience that reflects well on your brand.

Your Invoice is Your Final Impression

Your current invoices are not just administrative paperwork; they are a vital component of your brand image. They speak volumes about your professionalism, attention to detail, and operational efficiency. By neglecting their design and clarity, you are inadvertently sabotaging your hard-earned reputation, inviting delays, and contributing to the problem of unpaid invoices.

It's time to stop letting "good enough" kill your brand. Take control of your final client impression and demonstrate excellence from your first interaction to the final payment.