For many entrepreneurs and small business owners, the hardest part of the job isn't the work itself, it is keeping hold of the money once the work is done. It is a startling reality that many businesses operate in a "financial fog," where they know they are busy, but they aren't exactly sure where their revenue is at any given moment. If you aren't able to track money with precision, you aren't just disorganized; you are actively losing profit.

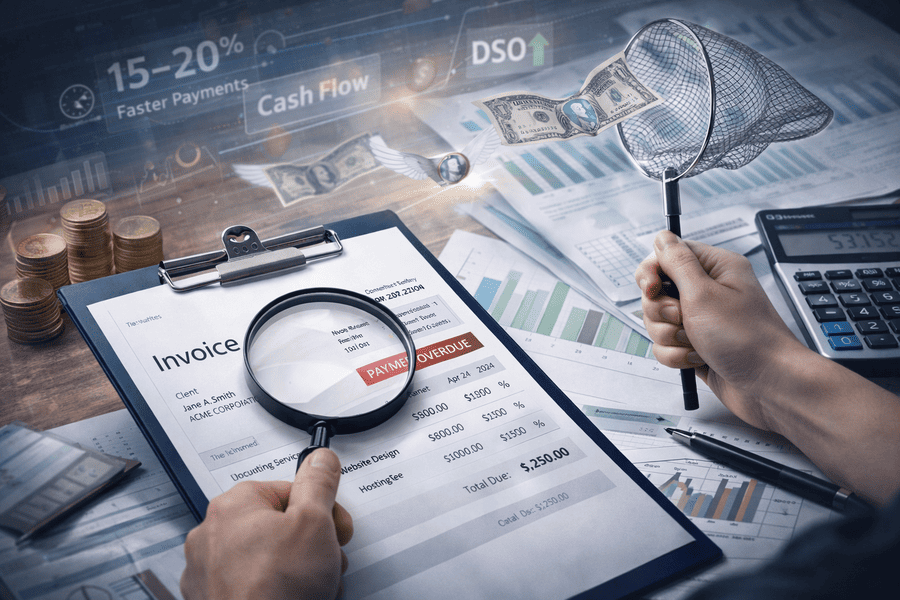

According to a comprehensive study by U.S. Bank, a staggering 82% of small businesses fail due to poor cash flow management. A significant portion of this failure comes down to "leakage", revenue that is earned but never collected because of poor money tracking systems. If you want to scale, you need a bulletproof system to track payment cycles and ensure that not a single cent slips through the cracks.

The High Cost of Financial Disorganization

When you don't have a centralized way to monitor your receivables, you're essentially playing a high-stakes game of memory. You might remember the big project you finished last Tuesday, but do you remember the small add-on service from three weeks ago?

Without an online invoice system, these small amounts go unbilled. Over a fiscal year, these "tiny" misses can add up to thousands of dollars in lost money. This is why financial visibility is considered the "Profit Hook", once you can see where every dollar is, you can "hook" it and pull it back into your business.

1. Why Manual Spreadsheets are the Enemy of Profit

Many startups begin by trying to track money using manual spreadsheets or handwritten ledgers. While this might work for your first two clients, it quickly becomes a liability. Manual entry is prone to human error, and spreadsheets are "static", they don't "talk" to you.

An online invoice generator, however, creates a digital paper trail that is dynamic. It allows you to:

- Sort by Status: See instantly who has paid, who is pending, and who is overdue.

- Search by Client: Pull up a full history of a client’s money trail in seconds.

- Identify Trends: Spot which clients are consistently late and adjust your terms accordingly.

2. The Power of Real-Time "Money Tracking"

In business, information is only useful if it is current. If you only check your bank balance at the end of the month, you are looking at a "post-mortem" of your business. To truly track payment efficiently, you need real-time data.

By moving your billing to a digital platform, you gain an immediate dashboard of your financial health. You can see your "Accounts Receivable" total at a glance. This high-level view allows you to make smarter decisions about expenses. Can you afford that new piece of equipment today? A quick look at your pending money will give you the answer.

3. Closing the Gap: Shortening the "DSO"

In the world of professional accounting, there is a metric called DSO (Days Sales Outstanding). This measures the average number of days it takes a company to collect payment after a sale has been made. A high DSO is a red flag for any business.

To lower your DSO and track money more effectively, you must reduce the "time to bill." Statistics from PYMNTS indicate that companies using automated billing systems see a 15% to 20% improvement in payment speed. When you send an online invoice the moment a project is signed off, you are significantly more likely to receive that money within your preferred window.

4. Using "Digital Breadcrumbs" to Track Payment

One of the biggest frustrations in business is the "I never got the email" excuse. This is a primary cause of money delays.

Modern online invoice tools provide "Read Receipts" and tracking logs. When you can see that a client opened the document on Monday at 10:00 AM, you have the data you need to follow up with confidence. This level of money tracking removes the guesswork and the awkwardness of the "just checking in" phone call. You are no longer guessing; you are managing.

5. Professionalism as a Collection Strategy

There is a psychological element to how people handle money. If a bill looks like it was thrown together in five minutes, the client may feel that paying it isn't an urgent priority. However, a professional, itemized document signals that you are a business that takes its money tracking seriously.

When a client receives a clear, professional online invoice, they are subconsciously signaled to follow your "rules." This leads to a higher rate of on-time payments and fewer "lost" invoices that never get paid.

6. Automating the "Money" Follow-Up

Let’s face it: no one likes being a debt collector. It’s the least favorite part of any entrepreneur's day. However, failing to follow up is how unpaid money turns into a permanent loss.

Automated systems allow you to track payment and trigger reminders at 3, 7, and 14 days past the due date. This keeps your cash flow moving without you having to lift a finger. This is the ultimate "Profit Hook", a system that works in the background to ensure you are paid every dollar you are owed while you focus on the work you love.

Visibility is the Key to Growth

You cannot manage what you cannot see. If you want to protect your profit and ensure the longevity of your business, you must move beyond "gut feelings" and into a system of total financial visibility.

The easy way to track every single dollar you are owed is to stop using scattered methods and start using a centralized, professional system. Every online invoice you send is a record, a reminder, and a professional promise that your work has value.